Cookies help us deliver our services. By using our services, you agree to our use of cookies.

You have no items in your shopping cart.

Filter by price

Products tagged with 'zero line cross'

Larry Williams Large Trade Index

Larry Williams Large Trade Index (LWTI) is an indicatory by Larry Williams as explained in his book "Trade Stocks and Commodities with the Insiders: Secrets of the COT Report".

The original concept was specifically based on Trader (or Market) Sentiment and predicting market reversals.

$9.90

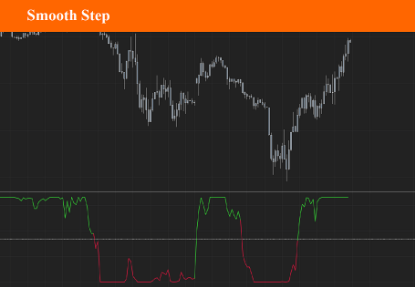

Smooth Step

This indicator was adopted from work done by a very smart guy named Kenneth H. Perlin, who is a professor at New York University in the Computer Science Department. His work centered around something called “Sigmoid Function” having a characteristic “S”-shaped curve or sigmoid curve

$9.90

Ehlers Elegant Oscillator

The Elegant Oscillator was created by John Ehlers (Stocks and Commodities Feb 2022 p.21)

The Elegant Oscillator is founded on the idea that price tend to return to “normal”, or average levels of its historical mean. It calculates the inverse Fisher transform of price and then applies the SuperSmoother to filter market noise and create a signal line.

$9.90

ChartMill Value

Developed by Dirk Vandycke, ChartMill Value indicator tracks how far the price spread is from its moving average. Since MA keeps increasing even when price consolidates or stalls, it is very difficult for the deviation from a moving average to remain in the overbought or oversold regions for extended periods, which represents a significant improvement over other oscillators such as the RSI and Stochastic indicators.

This indicator is best used with other oscillators, to confirm signals. Zero line crossovers should also be considered as signals.

This indicator will be able to colorize candles according to its trend (> 0 = up trend, < 0 down trend) and send alert when the zeroline is crossed.

$9.90

Moving Average Slope

The MA Slope indicator (Moving Average Slope) is a technical analysis tool used in trading and investing to measure the direction and steepness (rate of change) of a moving average over time. Instead of just tracking the value of a moving average (like SMA or EMA), the MA Slope indicator quantifies how quickly that average is rising or falling—essentially, it calculates the gradient or "slope" of the moving average line.

$9.90