Cookies help us deliver our services. By using our services, you agree to our use of cookies.

You have no items in your shopping cart.

Filter by price

Products tagged with 'moving average'

Asymmetrical RSI

ARSI, or the Asymmetrical Relative Strength Index, is a technical indicator that builds upon the traditional Relative Strength Index (RSI) by focusing on smoothing out market noise to identify trends more clearly. It was developed by Sylvain Vervoort to address some limitations of the standard RSI by using asymmetrical adjustments. This adaptation aims to provide clearer signals for entry and exit points in trading by making trend direction and strength more evident in volatile markets. The ARSI modifies the original RSI calculation by using a moving average and standard deviation to help filter out noise, improving the accuracy of identifying significant market moves. This can help traders respond earlier to market changes, with ARSI designed particularly for detecting both bullish and bearish momentum shifts more effectively

$9.90

SineWMA

The Sine Weighted Moving Average (SineWMA) is a type of moving average that uses a sine function as a weighting mechanism for price data. Unlike simple or exponential moving averages, the SineWMA applies weights in a sinusoidal pattern, giving more emphasis to certain data points based on their position in the series. This can make the SineWMA smoother and potentially more responsive to cycles in market data.

$0.00

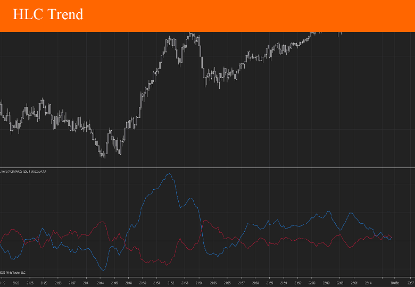

HLC Trend

The HLC Trend Indicator is a technical analysis tool used in trading to identify trends and potential entry/exit points in the market. It is based on the High, Low, and Close (HLC) prices of an asset, which are key components of candlestick or bar charts

$9.90